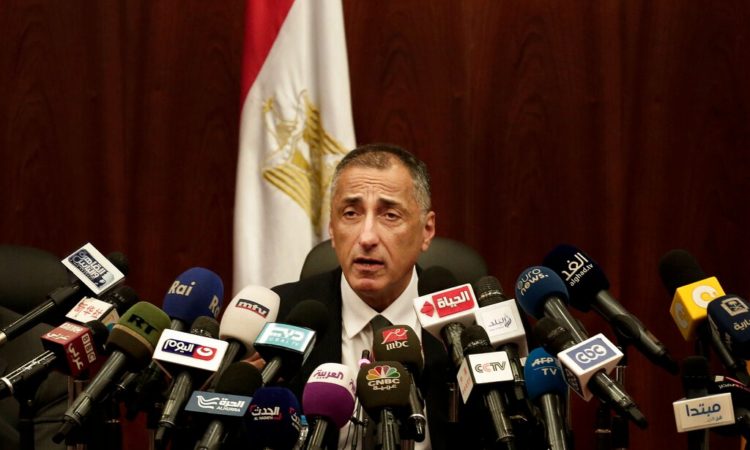

Tareq Amer, the governor of the Egyptian Central Bank, resigned Wednesday, state media reported in a country where inflation is running at 15 percent and devaluation continues to reduce household purchasing power.

President Abdel Fattah al-Sissi accepted the resignation of Mr. Amer, who had been in office since 2015 and whose term ran until 2023, and then appointed him as presidential adviser, the daily Al-Ahram reported.

The name of his replacement was not immediately announced.

The Egyptian pound is currently at its second all-time low, trading at 19.1 pounds to the dollar on Wednesday, a figure that has only been surpassed once, during the brutal devaluation in the winter of 2016.

Egypt devalued its currency again on March 21 and inflation is rampant. The most populous Arab country, the world’s largest importer of wheat –primarily from Russia and Ukraine, is suffering from the consequences of the conflict that started in February.

Inflation has now reached 15% in Egypt, driven by a rise in food prices of up to 66%.

Of the 103 million Egyptians, 30 million are considered poor and as many others are in precarious situations, according to the World Bank.

Moody’s agency now believes that Egypt is at risk of serious social unrest due to the economic crisis. It has changed its assessment from “stable” to “negative”.

It is particularly concerned about the melting of foreign currency reserves, which have fallen from 41 billion dollars in February to 33.1 billion at the end of July, according to the Central Bank. And this despite the deposit in late March by Saudi Arabia, a major ally of the regime of Mr. Sissi, five billion dollars.

Cairo is in discussions with the International Monetary Fund (IMF) for a new loan, while the country’s budget of about $160 billion is burdened by a public debt that reaches 90% of GDP.