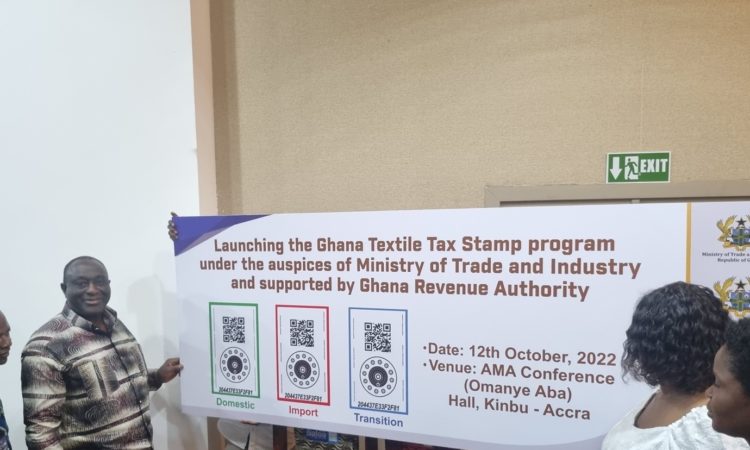

Local manufacturers, retailers and importers of textile prints sold in the market are expected to have stamps affixed on them by November 1, 2022 when government rolls out the textile tax stamp policy, Minister of Trade and Industry, Alan Kyerematen has announced.

Speaking to the press after the launch of the textiles tax stamp policy in Accra on Wednesday, the minister said “On the 1st of November, textiles tax stamp policy would be rolled out, meaning that both for locally manufactured prints and imported textile print that are sold in the market they should have stamps affixed to them and we have explained the different colour schemes associated with both imported and locally manufactured fabrics.

Also, to reduce the burden of those engaged in retail trade, we have agreed that any existing stock, that any trader has in his or her stall or store would be ringfenced in terms of the applications of these policy measures, meaning that existing stocks in stalls or stores would not be affected by these policy measures, and traders would be given a special stamp [blue coloured that would be affixed in existing stock so that they would be provided from any compliance requirement.”

The minister further explained that the move from government is not intended to introduce any tax measure nor is it intended to add to the prices or cost of the textile print in the market or create difficulties for those engaged in retail and wholesale trade, rather it will bring sanity in the retail trade in the textile print.

The move to push through this policy started with a stakeholder’s engagement from 2018 to ensure that there has been a wider consultation from parties involved, the minister added.

He adds “in terms of implementation we have given ourselves up to 1st of March 2023 for enforcement and compliance with the policy measures.”

The minister also indicated that it is in the interest of the government and Ghanaians in general, to see to the development and growth of domestic manufacturing in order to take full advantage of the AfCFTA which has a market size of over 1.3 billion people with combined GDP of more than $3.3 Trillion US Dollars.

The Head of Excise at Ghana Revenue Authority(GRA), Kwabena Apau Anto, urged manufacturers, retailers, and importers to prepare from November 1 to February, “to make sure that all the products going to the market are affixed with the stamp, the programme is essentially being rolled out by the Trade Ministry but GRA we have started the tax stamp and also leveraging on our law [Excise Duty Act and Tax Stamp Act] to introduce this policy and since we have the experience in this and we are ready to support in this regard.”

Faotumata Doro, MD Texstyles Ghana Ltd says her she was excited because “we have seen our businesses shrink over the years -we used to be over 15 textile industries contributing to more than 12percent of the country’s GDP, today we are left with four contributing to less than three percent, almost 2,500 employees instead of 25,000 employees that is a significant decrease, counterfeit today represent about 70percent on the market.

As long as there is a fair environment that makes sure that we are all abiding by the rule then it would be profitable for everybody for government, traders, local textile industry, so we are extremely happy about that,” she said.