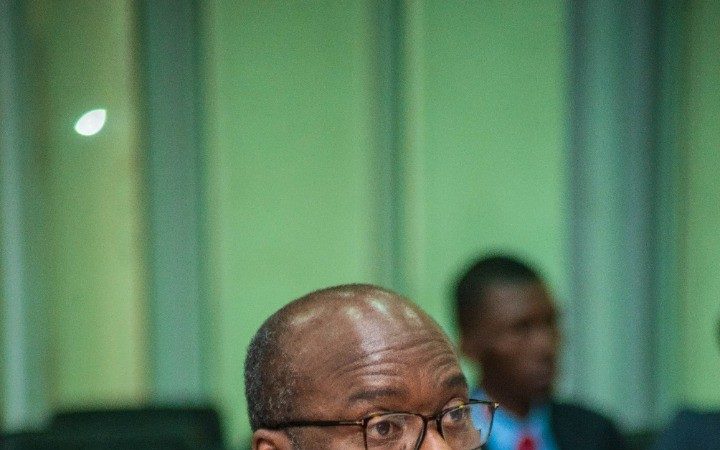

Central bank governor Dr. Ernest Addison has backed the barter of gold for oil policy and believes it would help lessen private sector pressure on the foreign exchange market.

Government last year announced a new policy to buy oil products with gold rather than US dollar reserves. The move, officials say is meant to tackle dwindling foreign currency reserves coupled with demand for dollars by oil importers, which is weakening the local cedi and increasing living costs.

Appearing before the Public Accounts Committee of Parliament on Monday to answer questions on the foreign exchange receipts and payments for half year and annual year for June 2020 and the final report, December 2020, Governor Addison was also asked a public interest question on the gold for oil programme.

He told members of the committee that “The idea behind it is that if we are able to have this government-to-government arrangement for crude oil we probably might get it at a cheaper price than what the private sector can do and also because the central bank had already started gold purchasing to boost our reserves, we already have an arrangement where we getting gold for reserves.

The idea is to use that part of it to support the oil operation and if this government-to-government arrangement works well, the idea is that the private sector -that is trying to chase foreign exchange in the market will finance their oil imports, will not be adding pressure to the foreign exchange market, those are the two benefits; first government to government benefit of being able to get crude oil at lower prices and then reducing private sector pressure on the foreign exchange market.”

Temporary arrangement

Further he stated that “Some of us thinks this is a temporary arrangement to deal with the crises that we have, others think it should be a permanent arrangement to deal with the permanent pressure on the currency, but it is too early to draw any conclusions.”

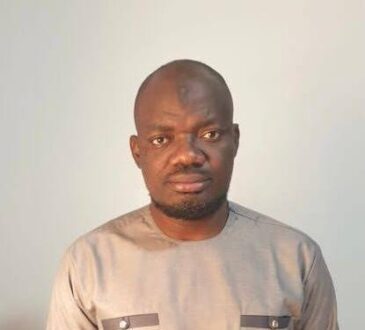

According to Mr.Stephen Opata, Director of Financial Markets/Gold for Oil programme, he indicated that as of 2021 data, Ghana produced 130 tonnes of gold, making it the largest producer in Africa.

“Our production for gold is much higher, the problem we have is that some of our production is not going through approved channels – and probably that is why this programme may be useful in the sense that if it is successful all gold from licensed exporters and community mines would be bought by PMMC, so at least if we are successful then we minimize the unapproved channels by which gold gets to Dubai.”

Sustainability

He also added that the country has what it takes to buy enough gold to sustain the programme, “currently the numbers we are looking at is about 160,000 ounces per month and that will represent about 50 to 60 percent of the consumption of the country and according to what PMMC indicates they can do, I think we have the volumes to support the programme at least for the 50 to 60 percent of our production.”

Already, the first consignment of the Gold for Oil Policy by the government to curtail the increasing depreciation of the cedi against the major currencies has arrived at the Tema Port and discharged into the receptacles of Bulk Oil Storage and Transportation Company (BOST).

The 41,000 metric tonnes of the petroleum products delivered by SCF YENISEI would be sold by BOST to bulk distributing companies (BDCs) around Ghana, valued at $40 million, it was brokered by the Economic Management Team led by Vice President Dr Mahamudu Bawumia.

Ghana’s Gross International Reserves stood at around $6.6bn at the end of September 2022, equating to less than three months of imports cover. That is down from around $9.7bn at the end of last year, according to the government.

The proposed policy is uncommon. While countries sometimes trade oil for other goods or commodities, such deals typically involve an oil-producing nation receiving non-oil goods rather than the opposite.

Ghana produces crude oil, but it has relied on imports for refined oil products since its only refinery shut down after an explosion in 2017.