The taxation of mobile money and digital transactions will require more learning and evidence to achieve the desired results, Roselyn Adadzewa Otoo, Project Director at ISSER has suggested.

According to her the evidence clearly shows that mobile money tax or e-levy is here to stay, so it is important that its modeling and implementation are done right by ensuring those activities are evidence-based and data-driven.

Speaking at the opening of the two-day workshop jointly organized by the International Centre for Tax Development (ICTD) and the Ghana Revenue Authority (GRA), to discuss how to make digital finance taxes successful and minimize its adverse impact on financial inclusion and the drive towards a cash-lite society, Adadzewa Otoo said “Tax receipts are consistently falling below projections indicating that there is still much to learn, we are seeing people trying to look for loopholes to avoid the taxes, people try to be fast more than government, it still points to one thing, we still need a lot of learning in this whole taxing mobile money or digital transactions.

It has been characterized by introduction, where you are forced to stop, go back to the drawing board., and try to cajole your people to come along, quite chaotic, either we are not taking the lessons, the evidence coming out from different countries to inform the rollout in new countries or we are yet to get the evidence right.

So far, 15 African countries have implemented digital finance taxes, but none of them has been able to realize anything close to the projected receipts.

In Ghana, the e-levy (electronic transfer levy) aimed to generate GH₵1.46 billion in its first two months but only reached GH₵93 million, less than 10% of the target. Initially set at 1.5% in 2022, the projected revenue was GH₵6.96 billion, later revised to GH₵611 million due to public resistance.

By the end of 2022, the e-levy collected GH₵612.34 million, slightly above the revised target. Despite initial resistance across Africa, digital money transfers are increasing, leading to rising tax revenues.

In 2023, the e-levy generated GH₵1.19 billion, surpassing the projected GHS1.11 billion by 7.5%. This shows an 85.7% growth compared to GH₵612 million in 2022, indicating a gradual improvement in revenue collection.

“The approach to mobile money tax cannot be like it is for traditional tax system simply because traditional tax systems are built on years of evidence and data gathering, whereas mobile money tax is completely new.

Available data from ISSER also reveal that taxes on MoMo, in Ghana and elsewhere, have also been justified as a way to “capture” those working in the informal economy, who are perceived as being untaxed. Critics have pointed out, however, that informal workers (who make up 89% of total employment in Ghana) already pay a range of fees and taxes. Therefore, they may be disproportionately affected by this new tax.

Despite much speculation about the impact of the e-levy, there has been little empirical evidence. In particular, it is important to consider how informal workers use mobile money, how the levy affects them, and how they perceive it.

Former Finance Minister Seth Terkper also emphasized the need for the government to accelerate the automation process. He believes that the current domestic system lacks solidity and that technology will significantly improve tax collection.

Terkper warns that if the automation process is delayed, taxpayers, especially the larger ones, will always stay ahead, leaving the GRA unable to keep up. He stresses that completing the automation, which began with ICUMS, is crucial for Ghana. This includes a domestic component allowing the Customs Division of GRA and the Domestic Tax Division to share information, thereby enhancing compliance.

The E-levy is advantageous because it is electronic, but there is currently no mechanism for MTN and other entities to access the necessary information.

Former Finance Minister, Seth Terkper urged the government to expedite the automation process because, at the moment, he reckons the domestic system is not as solid, so the use of technology definitely will enhance the collection of tax.

“Automation is the fund phase and that is why Ghana is being urged to finish the automation that started with now ICUMS, there is a domestic element so that the customs division of GRA and the domestic tax division can exchange information which will then enhance compliance.

E-levy comes in handy because it is electronic but we don’t have the mechanism where MTN and the rest are provided the information.”

Regarding the e-levy, while it initially affected mobile money usage minimally, it has not significantly harmed the market in the long term, Dr. Martin Hearson, a Research director International Centre for Tax and Development pointed out.

He added the e-levy is regressive, disproportionately affecting the poor over the wealthy. However, the 100ghc daily threshold offers some protection to the poor. “Considering Ghana’s high inflation rate, which has diminished the threshold’s value to 40%, it’s prudent to assess whether adjusting the threshold to match inflation is necessary.

Adjusting the threshold could have a minor impact on revenue but significantly benefit the poor. Conversely, removing the threshold would increase revenue but exacerbate the tax’s regressive nature. These factors should guide further discussion and decision-making on the matter.”

Charles Addae, an Assistant Commissioner at GRA, highlighted the purpose of the e-levy: to include the informal sector in the tax system. He noted that in 2022, GH₵600 million was collected, and in 2023, it rose to GH₵1.2 billion from the e-levy.

The aim is to enhance tax revenue without overburdening existing taxpayers, he stressed. Mr. Addae emphasized the importance of tapping into the informal sector to ensure everyone contributes to revenue collection. Traditionally, national revenue relied on established businesses and employed individuals, necessitating a shift towards incorporating the informal sector.

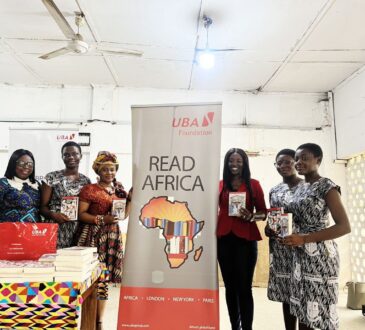

The workshop on the theme “Taxing Mobile Money – Lessons and Ways Forward” was organized to fashion out ways and strategies to collaborate in the area of tax research and promote and support the GRA’s research capacity to improve tax revenue mobilization effectively and equitably.

By Eugene Davis