Ghana was the second-largest recipient of remittances in Sub-Saharan Africa in 2023, as revealed in the World Bank’s 2023 Migration and Development report released on June 26, 2024. In 2022, Ghana recorded $4.7 billion in remittances, maintaining its second-place position.

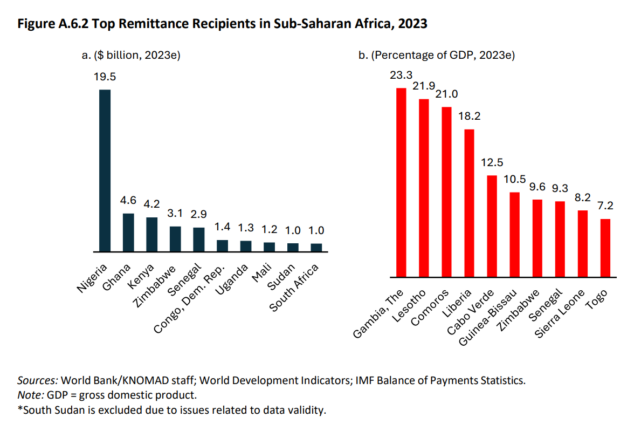

The report highlighted that the top recipients of remittances in Sub-Saharan Africa during the reviewed period were Nigeria, Ghana, Kenya, and Zimbabwe. Nigeria led the list with $19.5 billion, followed by Ghana with $4.6 billion, Kenya with $4.2 billion, and Zimbabwe with $2.1 billion.

Remittances have emerged as the most critical source of foreign exchange earnings for many countries in Sub-Saharan Africa. For example, in Kenya, remittances surpassed key exports such as tourism, tea, coffee, and horticulture. Countries heavily dependent on remittance receipts as a proportion of GDP include the Gambia, Lesotho, Comoros, Liberia, and Cabo Verde, with remittances contributing over a fifth of GDP in the first three nations.

The World Bank noted that remittance flows to Sub-Saharan Africa in 2023 were nearly 1.5 times the size of Foreign Direct Investment (FDI) flows and relatively more stable. The regional growth in remittances was primarily driven by significant increases in Uganda (15% to $1.4 billion), Rwanda (9.3% to $0.5 billion), Kenya (2.6% to $4.2 billion), and Tanzania (4% to $0.7 billion). However, remittances to Nigeria, which make up about 35% of the region’s total remittance inflows, decreased by 2.9% to $19.5 billion.

High Remittance Costs

The report also revealed that Sub-Saharan Africa continues to have the highest remittance costs globally. In the fourth quarter of 2023, senders paid an average of 7.9% to send $200 to African countries, compared to 7.4% in the same quarter of 2022. Remittance costs vary significantly across the region, ranging from 2.1% to 4.0% in the lowest-cost corridors to 18% to 36% in the highest-cost corridors.

Intraregional remittance costs remain particularly high. For instance, sending $200 in remittances from Tanzania to neighboring Kenya, Uganda, and Rwanda cost a migrant more than 33% in the fourth quarter of 2023.

This data underscores the importance of addressing remittance costs and enhancing financial inclusion to maximize the benefits of remittances for economic development in Sub-Saharan Africa.