Imagine interviewing in a company, and you get to know at the last stage of the interview that current employees of the company are unhappy, citing unpaid salaries and an unsupportive work environment as their reasons for wanting to leave.

Would you still want to join the company? It is the same for investors.

For a country grappling with high levels of poverty and badly needed foreign investments and lack of jobs, investors expect the government to create an enabling environment for the private sector to thrive.

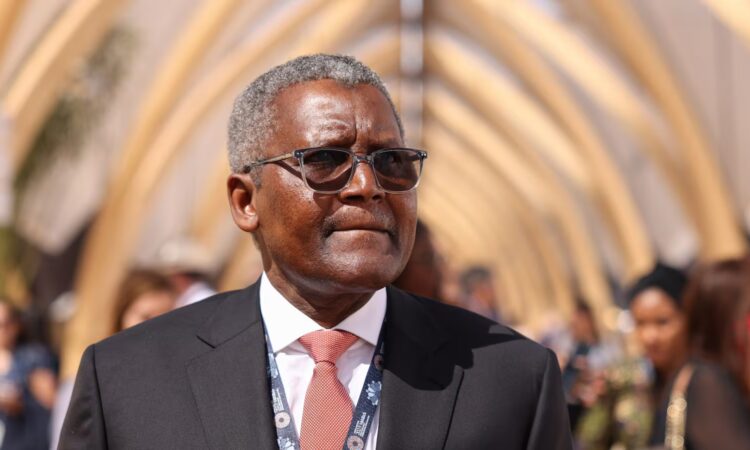

But that’s not happening. Nigerian business leaders and top corporate executives say the standoff between Aliko Dangote, president of Dangote Group, and Nigeria’s oil industry regulators over a plethora of issues regarding the project that has created at least 100,000 jobs is among a thousand and one ways of discouraging investors.

Dangote Refinery has created twice the number of jobs jointly generated by Apple’s contract manufacturers and component suppliers, including Foxconn, Wistron and Pegatron, in India in two years.

Its jobs are equivalent to what China’s biggest palm oil producer, Julong, promised to create in Africa in three years.

The refinery will earn over $25 billion in revenues and exports.

While Nigerian authorities fight Dangote and his refinery, another African president has invited him to put money into his country.

President Brice Oligui Nguema of Gabon invited Africa’s richest man on Tuesday to invest in cement and fertiliser production in Gabon.

Gabon’s president urged Dangote to explore potential investment opportunities in the country’s cement and fertilizer sectors, specifically urea and phosphate production.

Visionary leaders believe that Nigeria should do better in boosting investor confidence than in hurting it to drive investments and create more jobs for mostly young people.

Akinwumi Adesina, president of the African Development Bank, said on Tuesday that the dispute between the Nigerian National Petroleum Company (NNPC) Limited and Dangote Refinery is needless for the country at a time it should be building partnerships for rapid development.

“This whole disparaging of Dangote is uncalled for. It is self-defeating. And it is very bad for Nigeria. Who will want to come and invest in a country that disparages and undermines its own largest investor?” Adesina asked.

He added, “Investing is tough. Pettiness is easy. It sadly sends a signal that the price for sacrificing for Nigeria is to get sacrificed.”

In a statement seen by BusinessDay, the head of the continental financial institution further said, “Monopoly often exists where there are high barriers to entry or high capital costs.

“How many individuals or companies can do railways? How many can do refineries of the scale of Dangote Refineries?”

Adesina added, “In a nation that has been importing refined petroleum products for several decades, the abnormal simply became very normal. No smart investor would make a $19.5 billion investment and want it to be undermined by importers.”

Nigeria’s economy is in dire need of a rebirth. The country’s harsh business environment is worsened by the removal of a generous petrol subsidy and a naira freefall that has fueled imported inflation and triggered the worst cost of living crisis in a generation.

At 33.3 percent, the jobless rate soared to the highest in Africa even as the country’s decrepit infrastructure worsened, needing $3 trillion to fix.

For a country in dire of fresh investment, the Nigeria Employers’ Consultative Association (NECA), the umbrella organisation of employers in the organised private sector of Nigeria, said raging the accusation and counter-accusation have the potential to further stifle the already struggling economy, as it paints a scary picture for would-be local and foreign investors.

“For many years, the country struggled under the yoke of crass inefficiency in the management of our refineries, causing citizens to suffer from the huge leakage called fuel subsidy. The coming of the Dangote refinery, ordinarily should be a thing of joy. However, our contradictions have come to the forefront,” Wale-Smatt Oyerinde, director-general of NECA, said in an exclusive chat with BusinessDay.

The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) said last Thursday that Dangote is seeking a ban on diesel imports to boost the viability of the plant and questioned the quality of its fuel.

This was after the billionaire had said the state oil company had reneged on a deal to supply it with 300,000 barrels of crude a day.

“Building a refinery like this is supposed to be a pride for everybody,” the billionaire said, accusing the regulator of wanting to continue issuing import licenses for fuel (a lucrative source of income for Nigeria’s elite for decades) instead of allowing his refinery to thrive.

For Dangote, whose business empire was allowed to flourish under previous administrations in return for his billions of dollar investments, the dispute is a shock.

“We believe that all efforts should be made to support the Dangote Refinery to wean the nation off persistent fuel imports.

“Ironically, we strangulate Nigerian entrepreneurs and at the same time urge foreigners to come to invest in Nigeria,” Oyerinde said.

Nigeria has a young population, most of who are less than 25 and are raging to move abroad due to limited opportunities and lack of jobs. Youths are planning to stage a protest due to a strangulating economy and rising inflation. Yet the government authorities are trying to stifle an investment that creates thousands of jobs, analysts say.

Peter Obi, presidential candidate of the Labour Party (LP) in the 2023 election, asked the Federal Government to provide necessary support for the operation of the Dangote refinery.

In a statement on Tuesday via X, Obi emphasised the critical importance of the refinery to Nigeria’s economic future.

“The recent conflicts between Dangote Industries and some government agencies are deeply troubling,” Obi stated.

He stressed that the issue transcends political affiliations and personal grievances and is fundamentally about Nigeria’s economy and the well-being of its citizens.

Highlighting the refinery’s potential impact, Obi said, “The refinery has the potential to generate approximately $21 billion in annual revenue and create over 100,000 jobs, with numerous additional positive impacts on the economy.”

– businessdayng