Economists are divided over whether Ghana’s central bank will extend its interest rate pause or cut borrowing cost on Friday.

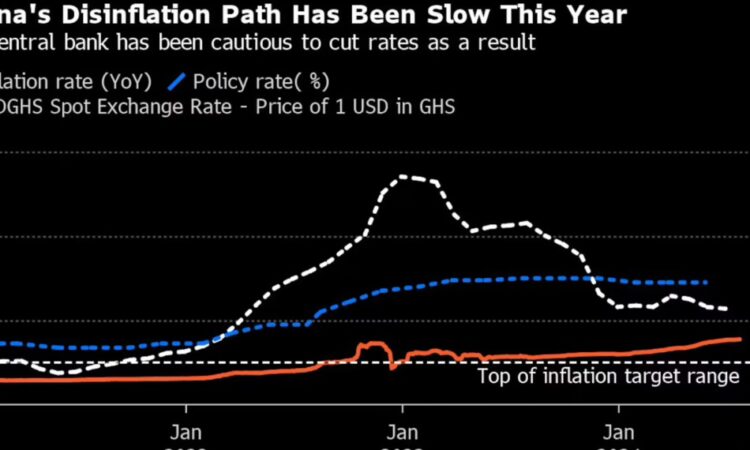

A spurt of price pressures in the private sector, slower-than-expected disinflation and the battered cedi have clouded the outlook.

The uncertainty has left economists split in predicting the central bank’s move. JPMorgan Chase & Co. and Absa Group Ltd. are among the slight majority expecting the monetary policy committee to leave the benchmark interest rate at 29%, when Governor Ernest Addison gives the panel’s decision in the capital, Accra. BancTrust & Co. Investment Bank and REDD Intelligence are among those predicting a cut, according to a Bloomberg survey.

“With the currency under pressure, we believe that the MPC could delay its policy rate cut to September although it is likely to be a close call,” said Absa economists led by Ridle Markus in a research note. Heightened inflationary pressures from a hike in electricity and water tariffs in July and the steep depreciation in the cedi against the dollar this year may also make it reluctant to lower rates, they said.

Factors that could persuade it to cut include the “recent stabilization of the cedi and food staples coming to market after harvest,” which should allow inflation to ease further toward 20% in the coming months from 22.8% in June, said Mark Bohlund, a senior credit research analyst at REDD Intelligence.

While the cedi has lost almost 23% of its value against the dollar it has stabilized this month.

A marginal reduction of 100 basis points will send a positive signal that “both the monetary and fiscals of the economy are headed in the right direction,” said Godfred Bokpin, a finance professor at the University of Ghana.

Finance Minister Mohammed Amin Adam earlier this week said the nation’s economic growth forecast was revised to 3.1% in 2024 from 2.8%, after completing an overhaul of $43 billion in debts and that inflation will likely end the year at 15%.

– Bloomberg