The MIIF small scale gold mining incubation program – A catalyst for growth in the mining sector

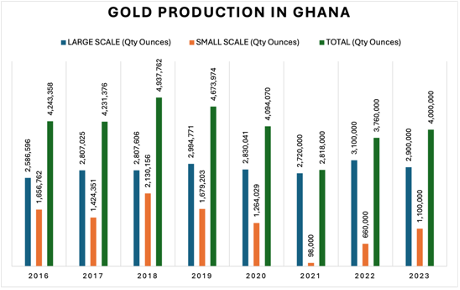

The small-scale mining sector contributes approximately 35% of all gold produced in Ghana. The sector has seen significant growth over the past two decades due to increased participation across the length and breadth of the country. Artisanal mining currently employs at least 1.5 million people directly and indirectly.

ENVIRONMENTAL AND SOCIAL IMPACT

The growth in production has also come with negative externali- ties, including wanton environmental degradation accentuated using mercury and other unsafe practices. The sector has also seen the influx of foreigners financing illegal miners in exchange for heavily discounted gold which perpetuates a poverty cycle and inhibits the growth of the sector. The impact on the gold ecosystem and value chain development has been severe on revenue mobilization, while the high incidence of smuggling and other violent crimes in mining communities has only served to rob the country of progress.

GOVERNMENT INTERVENTION THROUGH MIIF

Through its strategic vision, the government through MIIF decid- ed to undertake pragmatic and sustainable long-term policies and program to harness the maximum benefit from the artisanal and small-scale mining sub-sector for the benefit of Ghanaians. An initial $60million has been earmarked for the program over the next 5 years. Under the program MIIF will provide equity financing by deploying capital to qualified entities under a well-defined selection process.

THE SMALL-SCALE MINING INCUBATION PROGRAM (SSMIP)

Under the Government support program for the sub-sector, MIIF introduced the Small-Scale Mining Incubation Program (SSMIP), targeted at licensed small-scale entities engaged in hard rock or alluvial mining. The program is well aligned with the MIIF Strate- gic Plan with the primary objective of supporting Ghanaian companies in the mining and allied industries through direct investment and financing.

The program is pivoted on these four channels Provision of working capital

Support in the purchase and deployment of mining machinery in an environmentally sustainable manner

Support with corporate governance structures and responsible mining including traceability mechanisms.

Provide access to the international market through the MIIF Gold Trade Desk

THE GOAL OF THE SSMIP

The SSMIP aims to create an accelerated development plan to support capacity development with the help of other key stakeholders. It provides assessment of reserves and the life of these mines. The program seeks to help develop small mines with potential to grow into mid-tier (junior mines), then to large-scale mines including listing on the alternative exchange.

- Transform Small-Scale Companies: Promote wholly owned Ghanaian small-scale mining companies into mid-tier, then to large-scale companies by providing

- technical support and long-term capital.

SSMIP DESIGN AND FORMULATION

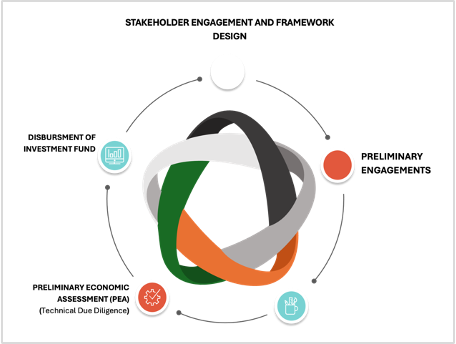

A. Stakeholder Engagement and framework design

In 2021, MIIF commenced an initial stakeholder consultation with the Ministry of Lands and Natural Resources, Ghana Chamber of Mines, Minerals Commission (MINCOM), Ghana National Association of Small-Scale Miners (GNASSM), and Precious Minerals Marketing Company (PMMC). The engagement with these stakeholders was to solicit their input into the drafting of the SSMIP framework, and to seek support to implement SSMIP. The framework was submitted to the board for their review and approval in the first quarter of 2022.

B. Preliminary Engagements

Following the discussions with all stakeholders, a list of 60 licensed small-scale entities in good standing was obtained from MINCOM in consultation with GNASSM. The list was then subjected to MIIF’s selection criteria. An initial visit was made to

16 pre-qualified small-scale entities across the country to ascertain their scope of operations, production figures, challenges and opportunities for investment. Out of this number, 10 entities were selected to participate in the pilot phase. These entities were grouped into two cohorts, with each cohort consisting of five entities.

In 2023, a Technical Review Panel (TRP) committee made up of mining professionals (geologists, mining engineers, metallurgists, mine plan experts etc.) was formed to further review and re-validate the economic viability and requirements for growth of the selected small-scale entities.

After an initial engagement between the TRP committee and the entities, the TRP committee recommended a Preliminary Economic Assessment (PEA) be conducted on all entities to be considered for SSMIP to further de-risk the program for investment decision making.

DE-RISKING MECHANISMS FOR THE INVESTMENT

A .Legal Due Diligence

As part of the process, legal due diligence was done to investigate the operations of the companies to identify potential risks impacting the implementation and success of the SSMIP. Areas of focus under this activity includes: Corporate Structure and Ownership, Financial Assessment, Business Plan Review, Asset Evaluation, Management and Staff, Operational Efficiency and Legal Obligations.

Indicative term sheets consisting of terms of engagement were shared with the entities for their consideration in the first quarter, 2024. The term sheet captures among others MIIF equity participation and deployment of capital, dividend rates and off-take agreements.

B. Preliminary Economic Assessment (PEA)

In January 2024, MIIF in consultation with TRP committee and approval from Public Procurement Authority (PPA) engaged UMaT Consultancy and Support Services Ltd (UMaT) as its independent consultant for the program. The consultant was tasked to conduct a comprehensive PEA on all entities under the program and submit reports detailing the current state of the mine, Mineral Resource Estimation, Mine Planning and Design, Metallurgical and Mineral Processing Studies to the Fund (MIIF), along with recommendations for investment decisions based on these key findings.

As at end of June, 2024, comprehensive PEA has been conducted on all the 10 entities under the pilot phase. Cohort I, which is made up of 5 entities (3 hard rock mines and 2 alluvial mines) has successfully completed all the stages under the PEA.

UMaT is expected to submit its final reports alongside recommendations from TRP to MIIF for investment decision by end-July 2024. MIIF expects to deploy capital to the entities by early August, 2024.

The 5 entities (4 hard rock and 1 alluvial mine) under cohort II are at the various stages of the PEA. It is expected that the report and recommendations of the PEA for Cohort II would be ready by end of July 2024.

Remarks from Chief Technical Officer:

Commenting on the SSMIP program, the Chief Technical Officer of MIIF, Mr Barning, intimated that the program seeks to bring into the small-scale mining sub-sector the key-mining development practices and operational plans that have made the large-scale mining companies so successful.

Remarks from the Chief Investment Officer:

Mr Sorkpor, the CIO of MIIF, indicated that he was extremely pleased with the rigorous nature of the processes for evaluating and establishing the economic viability of the projects MIIF seeks to invest in and the returns that would ultimately accrue to the shareholders. Mr Sorkpor further indicated that, a successful implementation over the next five year could see Ghana triple its small-scale gold production.

Remarks from the Chief Executive Officer:

The CEO of MIIF, Mr. Koranteng indicated that the program seeks to bridge the funding gap that has existed over the years and have prevented the sub-sector from realizing its full potential. He further indicated that MIIF’s involvement through SSMIP incorporates de-risking measures and mechanisms that should provide the comfort that co-investors and the banking and financial institutions need to be able to provide further capital support to the entities. This will help formalize the sector and assist in the fight against illegal mining.

Remarks from Board Chair:

Prof Boateng, the Board Chair of MIIF, indicated that MIIF was setup to maximize revenues generated by the State from mining operations. He further intimated that The Fund cannot rely solely on royalties accruing to the State, it must carefully diversify its investment portfolio into various asset classes.

He further stated that SSMIP fits into and is well aligned to the transformation agenda of the President of the Republic, who advised the Fund to help build local champions in the mining industry.