Retirement planning is a crucial aspect of securing one’s financial future, yet many individuals struggle to create and maintain an effective plan.

The lack of preparation for retirement isn’t just a personal financial risk, it’s also a potential crisis that could send shockwaves through their families and negatively impact future generations. That’s because, without adequate retirement savings, individuals may find themselves relying heavily on their children and other family members for financial support, creating a severe strain that can prevent the ability of the next generation to prepare properly for their own retirement.

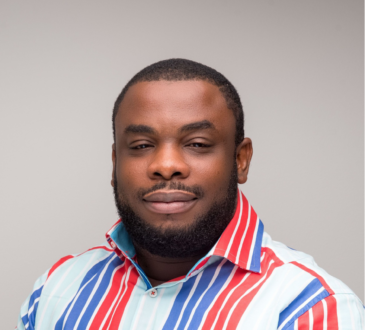

Akweley Laryea, Head of Retail Banking at First National Bank Ghana explained that such a domino effect of financial burden is a growing concern mostly in Ghana, but it’s not an inevitable fate. There are concrete steps that anyone, regardless of age or current financial status, can take to mitigate this risk and work towards a more secure retirement. “By acting now, you can reduce the likelihood of becoming a financial burden on your loved ones in your golden years”, says Akweley.

She suggests five steps you can take today to safeguard your future and protect your family’s financial wellbeing:

- Work out your retirement ‘magic numbers’: the first step towards a secure retirement is understanding exactly when you want to retire and how much money you will need to maintain your desired lifestyle. This involves carefully considering when you want to retire and what you’d like to be doing in your twilight years. Working out your ‘magic number’ is crucial. It’s not just about maintaining your current standard of living, but also accounting for potential increased healthcare costs and other retirement-specific expenses.”

- Grow your money wisely: Once you’ve determined your financial goals, it’s time to focus on growing your wealth. It’s best to aim for a balanced combination of short- and long-term savings and investment accounts. For short- to medium-term goals, consider options like savings account which enables more disciplined savings or Fixed Deposit accounts, which offer guaranteed returns and allow you to set the terms for accessing your money.

For long-term retirement planning and saving, she suggests investment and saving options which provides solid tax benefits and compound growth over time make a lot of difference. They help you to maximise your returns and provide you with a useful cash buffer for expenses once you’ve retired.

- Develop a long-term healthcare plan: As we age, healthcare costs increase significantly. Planning for these potential costs is essential to avoid burdening your family. Consider whether you have the resources to remain financially independent and pay for long-term medical costs and care if needed. This might involve downsizing your home and living costs in retirement, and setting aside a specific savings fund or ensuring you can afford to continue your medical insurance premiums for healthcare expenses after retirement.

- Establish and grow an emergency savings account: Unexpected expenses can quickly derail even the best-laid retirement plans. Starting an emergency savings account as soon as you can, and then consistently contributing to it, can provide a crucial financial buffer. She highlights the importance of balancing growth with access for an account like this, emphasising that you may have to sacrifice a little bit of the interest you’d get on an account like a fixed deposit, so that you have immediate access to your money. “A savings account offers a flexible solution with immediate access to your funds, and it still provides a competitive interest rate so you can still grow your money over time”, she added.

- Create a debt elimination strategy: Entering retirement debt-free is one of the most effective ways to ensure financial independence and avoid burdening your family. Akweley says that carrying debt into retirement can significantly reduce your disposable income and put unnecessary strain on your finances hence we strongly advise debt repayment as part of any retirement plan. She recommends that you start by listing all your debts and their interest rates, then focus on paying off high-interest debts first while maintaining minimum payments on others.

Even though there are structured mandatory retirement planning for employees and self-employed in Ghana like Tier 1, Tier 2, and the optional Tier 3, it is also important for individuals to take their future into their own hands by putting in place additional plans to complement whatever funds or support one would receive from the pension funds at retirement.

“The key to avoiding becoming a financial burden on your family in retirement is to take proactive steps towards financial independence starting now. No matter what age you are or where you are in your career today, every step you take towards financial security later in your life is an investment in your future and your family’s peace of mind,” concludes Akweley.