Business succession planning is a critical aspect of estate and gift planning, particularly for family-owned businesses or closely-held companies in Ghana.

Given the growing number of successful family-owned businesses in the country, planning for the continuity of these enterprises across generations has become essential. A well-structured estate and gift plan can ensure the company thrives and survives leadership transitions while addressing legal, tax, and family dynamics.

The Importance of Business Succession Planning

In Ghana, many businesses are run by individuals or families who may not have clear plans for transferring ownership or leadership to the next generation. The absence of a succession plan often leads to operational disruptions, legal disputes, and even the collapse of the business. A business succession plan ensures that:

- The business continues to operate smoothly in the event of the owner’s death, incapacity, or retirement.

- Ownership and control are transferred in a manner that aligns with the founder’s vision.

- Family members or chosen successors are prepared to take over management roles.

Identifying the Right Successor

One of the most crucial decisions in succession planning is identifying the right successor or successors. In many cases, the founder or owner may wish to keep the business within the family, passing it on to children or other relatives. In other cases, they may consider key employees or external buyers. In Ghana, this decision can be influenced by cultural expectations, but the following factors should also be considered:

- Skills and Experience: Does the successor have the necessary skills and experience to run the business?

- Interest: Is the successor genuinely interested in taking over the business, or are they being pressured by family obligations?

- Family Dynamics: If more than one family member is involved, how will ownership be divided without causing conflict?

Structuring the Transfer of Ownership

The transfer of business ownership can be structured in several ways, depending on the owner’s goals, the financial structure of the business, and the applicable legal framework in Ghana.

- Gifting Business Shares: Business owners can transfer ownership to successors through gifts. Under Ghanaian law, some provisions govern how gifts are treated for tax purposes, especially if the transfer involves significant assets like a business. Transferring shares gradually over time may help minimize the tax burden and ensure a smoother transition.

- Family Trusts: A family trust is an effective way to hold business assets and manage their transfer across generations. This allows the owner to maintain control over the business while gradually transferring economic benefits to heirs or successors. Trusts also protect against family disputes over business control.

- Sale to Successors: In some cases, business owners may sell the business to their successors, either family members or key employees. The sale can be structured in a tax-efficient way to ensure the business can afford to pay for the transfer without significantly affecting cash flow.

The Role of Wills and Testamentary Transfers

In Ghana, drafting a will is a critical step in estate and gift planning. A will clearly outlines how assets, including business interests, are to be distributed upon death. Without a valid will, the distribution of the business may be governed by intestate laws, which could lead to conflicts or unintended outcomes. Testamentary transfers (i.e., transferring the business after death through a will) offer control over the distribution of assets but come with the risk of estate taxes and probate delays.

Tax Implications in Business Succession

Taxation is an important consideration in estate and gift planning for business succession in Ghana. Business owners need to understand the tax implications of transferring assets, either during their lifetime or upon death.

- Gift Tax: When a business owner transfers assets as gifts during their lifetime, these gifts may be subject to Ghana’s gift tax laws. This tax is imposed on certain transfers of property, including business assets, and it’s important to plan for this when considering gifting as part of succession.

- Capital Gains Tax: If the business is sold to a successor, capital gains tax may apply to the transaction, depending on the structure of the sale and the value of the business. Planning for these taxes in advance can minimize their impact on the business’s liquidity and profitability.

- Estate Tax: While Ghana currently does not have an estate tax in the same way that many Western countries do, business owners should still be mindful of how local tax laws affect the transfer of assets upon death. Changes in tax laws or new policies may introduce taxes that affect business transfers.

Using Buy-Sell Agreements

A buy-sell agreement is a legal arrangement that outlines how business ownership will be transferred upon the death, retirement, or incapacity of the owner. These agreements are particularly useful in businesses with multiple owners or partners. A buy-sell agreement can:

- Provide a clear framework for how the business will be valued and sold.

- Avoid disputes among heirs or surviving partners.

- Ensure that successors have the resources to buy out other owners or the estate of the deceased owner.

Buy-sell agreements in Ghana are usually funded through life insurance or other financial products to ensure liquidity when the time comes to execute the transfer.

Use of Trusts and Other Legal Structures

In Ghana, the use of trusts is becoming more common in estate and gift planning for business succession. Trusts allow for a structured and controlled transfer of assets, helping to mitigate family conflicts and providing protection against creditors or legal challenges.

- Living Trusts: A living trust allows the business owner to retain control of the business while alive but ensures that upon their death, the business passes seamlessly to the chosen successor without the need for probate.

- Irrevocable Trusts: An irrevocable trust can be set up to transfer the business out of the owner’s estate, which may have future tax benefits and provide asset protection from creditors.

Preparing the Next Generation

Business succession planning is not only about legal and financial strategies; it’s also about preparing the next generation of leaders. In Ghana, where family businesses often form the backbone of the economy, successors must be adequately trained and mentored to take over the business. This involves:

- Providing them with education and training in business management.

- Involving them in decision-making processes early on.

- Aligning the vision for the future of the business.

Regular Review of the Succession Plan

Business owners in Ghana must regularly review their succession plans to ensure they remain relevant as the business grows or family circumstances change. This includes adjusting the plan in response to new tax laws, changes in family dynamics, or shifts in the business environment.

Estate and gift planning for business succession in Ghana requires careful consideration of family dynamics, tax laws, and legal frameworks. By developing a clear and structured succession plan, business owners can ensure the longevity and success of their enterprise across generations. Working with experienced legal, financial, and tax professionals in Ghana is essential to navigating the complexities of succession planning and protecting the business’s future.

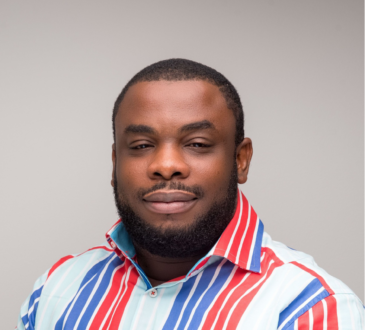

By Peter Asare Nyarko, Executive Director, Center for Financial Literacy Education Africa