Parliament reaffirms commitment to openness, inclusion, and gender equity on International Day of Parliamentarianism

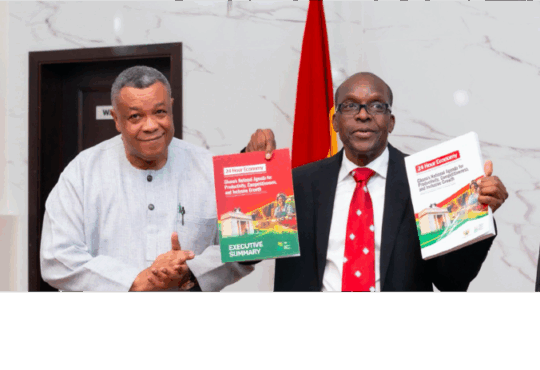

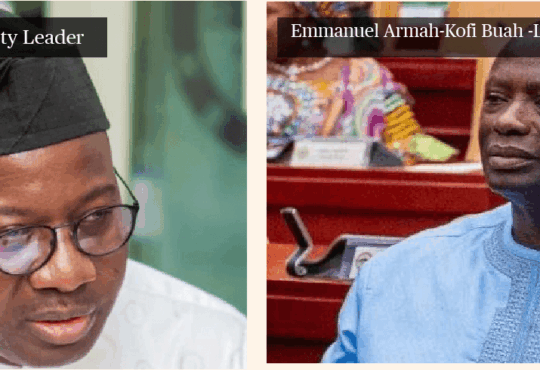

Ghana’s Parliament has reaffirmed its dedication to transparency, inclusive governance, and gender equity during the commemoration of the International Day of Parliamentarianism. The event, held at Parliament House in Accra, featured a triple-launch ceremony to mark the day—globally observed every 30th June under the auspices of the Inter-Parliamentary Union (IPU)....