Episode 1

Why did Ghana Opt for Financial Assistance in 2014?

Ghana has been a member of the IMF since September, 1957 and has benefitted from several technical and financial assistance from the Fund. Notable IMF programmes Ghana has benefitted from include the Stand-By Agreement (SBA) in 1966, the Structural Adjustment Programme (SAP) in 1983, the Enhanced Structural Adjustment Facility (ESAF) in 1989, the Highly Indebted Poor Countries (HIPC) initiative which was rolled out in collaboration with the WB in 2002. In 2009, Ghana again benefitted from the Poverty Reduction and Growth Facility (PRGF) from the Fund.

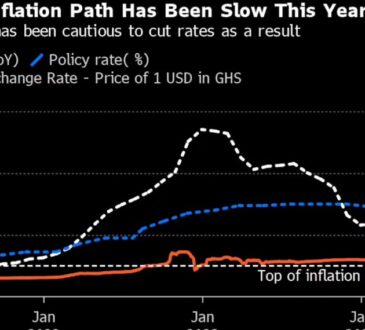

Ghana’s macroeconomic performance over the recent years has been mixed. After recording a Gross Domestic Product (GDP) growth rate of 14 percent in 2011 largely driven by inflows from the oil and gas, GDP growth declined drastically to 4 percent in 2014 amidst huge public debt and Balance of Payment (BoP) deficit. At a Benchmark revenue projection of US$93.34 a barrel for 2014, crude oil prices declined to US$82 a barrel in September 2014 and further below US$ 40 per barrel which caused a revenue shortfall. The 91-day Treasury bill rate increased to 25.5 percent in September 2014 compared to 21.59 percent the previous year. As at the end of December 2013, inflation rate stood at 13.5 percent. This increased to 17 percent in 2014.

On currency volatility, the cedi depreciated by 31.19 percent against the US dollar in the first nine months of 2014, compared to 4.12 percent recorded same period in 2013. Furthermore, on sectoral analysis, Industry sector growth declined from 7.3 percent in 2013 to 4.6 percent in 2014. Similar decline in Services sector was recorded; it grew at 4.59 percent in 2014 as compared to 9.6 percent in 2013. In the Agriculture sector, growth recovered marginally from 5.2 percent in 2013 to 5.3 percent in 2014. The economic headwinds aforementioned accounted for a bailout request from Ghana to address the risks to the country’s medium term economic prospects in August 2014.

On 3rd April, 2015, IMF’s Executive Board approved a three-year arrangement under the ECF for Ghana in an amount equivalent to Special Drawing Right (SDR) 664.20 million (180% of quota or about US$918 million) in support of Ghana’s medium-term economic reform.

Was the 2014 request for a bailout entirely self-inflicted?

NO!!

Apart from fiscal indiscipline.

- There were external shocks as well. Crude oil prices crushed. In fact, crude oil prices plunged to a low of US$45.0 per barrel compared to a bench mark revenue projection of US$99.38 per barrel in the 2015 Budget.

- Again, there was disruption in gas supply for two-and-a-half years and there was simultaneous fall in cocoa and gold prices.

- The disruption in gas supply and the low level of water in the Bui, Akosombo and Kpong dams due to climate change continued to pose power supply challenges, reduction in generation capacity and recurring power outages.

- Non-disbursement of programme grants from Ghana’s development partners.

Is the 2022 request for a bailout entirely self-inflicted?

NO!!

Apart from fiscal indiscipline.

- The Covid-19 pandemic and

- The Russia-Ukraine War have caused economic headwinds to the Ghanaian economy.

How can Ghana build a resilient economy to withstand external shocks?

- Enhance domestic revenue mobilization. Tax to GDP ratio is currently at 12%.

- Rationalize expenditure. The 2022 budget deficit is estimated at GH¢ 37 billion. It could be higher with some revenue lines underperforming while expenditure balloons.

- Promote import substitution industrialization. Continue with policies such as the 1D1F, PFJ policies etc.

- Promote export led industrialization.

- Pass tax exemption bill into law.

- Treat corruption and procurement breaches as an economic policy.

- Promulgate a long-term development plan where successive governments will adhere to it.

BY: Emmanuel Amoah-Darkwah

Economist/ Partner @ C-KADD Global