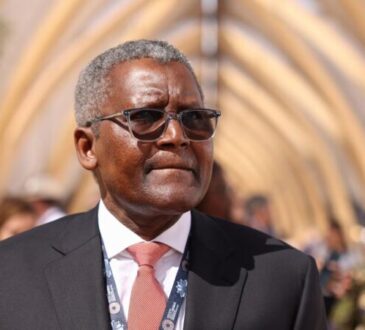

Que: Who is Tapfuma Musewe, what is your background?

Ans: I am a trade and investment executive with expertise in connecting African markets and other regions of the world. Having grown up a Canadian citizen, my passion led me to spend most of my working life in several African countries, like Ghana and South Africa. This has given me a unique understanding in establishing business and achieving growth in challenging economic environments. I am also a Managing Director at private equity firm Raygan Mills, which invests in growth companies across Africa. I also take every opportunity to provide mentorship to youth and young founders.

Que: What is the function of the Afrifursa Fintech Summit 2022?

Ans: Afrifursa is a new way to experience the dynamic people, innovation and opportunities for collaboration that exist in Africa. It was created out of a need to shift the narrative around Africa to a more accurate portrayal of its opportunities for engagement.

Que: Where and how can people register for the summit?

Ans: AFRIFIN is an 100% online event. Masterclasses will be held on the 17th of September 2022 from 10am – 1pm ET/ 4pm – 7pm CAT; the summit itself will be held on the 22nd of September 2022 from 10 am – 4 pm ET/ 4 pm – 10 pm CAT. You are warmly encouraged to register at afrifin2022.

Que: What would you say to young Africans who are passionate about Fintechs?

Ans: Fintech provides an excellent opportunity for young Africans to pursue a dynamic career with long term potential, that can catalyze great impact while providing you with a good income. The thing about most successful fintechs is that they address common problems that most African youth can identify with; you have the opportunity to build for your generation and the future.

Africa is still generally very underserved when it comes to fintechs (573 fintechs per 1.3 billion people in Africa vs. 8,775 fintechs per 330 million people in the US according to Forbes), so the market is ripe for innovation to meet underserved needs.

That being said, the industry often requires technical roles and people who are specialists in supporting roles like marketing and strategy. So get inspired by the opportunities, but put in the work to make sure you are an attractive employment candidate or an investable entrepreneur.

Que: What would you say to Canadian companies interested in investing in Africa?

Ans: I would say, it’s about time! Recognizing the long term value offered in African markets versus the unfounded risk premiums often associated with investing in Africa is a critical step in the right direction. However, Africa is a highly nuanced market with over 2000 languages, 54 countries, differing regulatory schemes, sophisticated consumer habits, etc. This means you start with a massive information disadvantage which is usually best solved by engaging African Diasporans who know how to navigate their home markets and the Canadian market; these Diasporans act as a bridge to local partners which is critical to your success when investing in a new market.