Prof Abor’s book highlights key role of banking and finance for African economies

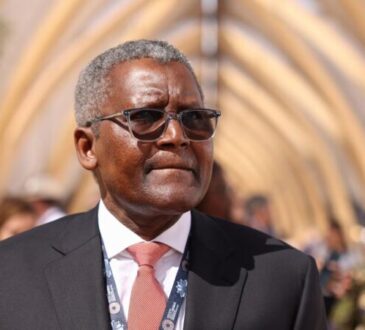

A Financial economist and the immediate past Dean of the University of Ghana Business School (UGBS), Prof. Joshua Yindenaba Abor, believes banking and financial markets continue to play a major role in the growth of various economies, including Ghana and it is critical to understand how Africa’s financial systems work in order to fashion out long term reforms.

According to Prof. Abor, banking and the financial markets play a significant role in the growth of various economies. Although a number of handbooks on banking and finance exist, they mainly focus on Europe, America and Asia.

At the launch of his new book “The Economics of Banking and Finance in Africa” which is a two-volume edited book made up of thirty chapters and published by Palgrave Macmillan (Springer Nature). The book evaluates the characteristics and developments in Africa’s financial systems, including monetary policy, structured finance, sustainable finance and banking, FinTech, RegTech, SupTech, inclusive finance, the role of regulation in dealing with banking crises, the impact of the COVID-19 pandemic on Africa’s financial systems and how to reform the post-COVID-19 financial systems. It is made up of contributions from scholars in finance and economics as well as financial market practitioners.

Speaking at the launch of his new book last month in Accra, Prof. Abor said “Banking and the financial markets play a significant role in the growth of various economies. Although a number of handbooks on banking and finance exist, they mainly focus on Europe, America and Asia. Banks and financial markets in Africa are confronted with different challenges and therefore present a unique case to understand Africa’s financial systems. A number of African countries have experienced banking crises and it is important to examine these issues as well as the regulatory regimes required to address them.”

This edited book contributes to the limited texts in the area by providing a comprehensive resource on banking and finance for students, scholars, researchers, policymakers, and financial market practitioners. It contains various theoretical and empirical chapters on banking and finance in Africa.

The thirty chapters are grouped under seven broad Parts. In Part I a broad overview of Africa’s financial systems is provided. Additionally, the purpose of the book as well as an overview of the chapters in the book are provided.

Part II of the book has 4 chapters and covers topics related to FinTech, Financial inclusion and Banking Sector Development in Africa. In this part of the book the relationship between inflation, interest rates and exchange rates in Africa is discussed. Also there is a chapter that looks at competition and market structure and how reducing information asymmetry will reduce monopolistic power of the banking sector in Africa. Another chapter also discusses how increased financial inclusion complements banking sector development and stability in the financial system in Africa. The last chapter in this part of the book discusses the development of FinTechs and their implication for banks and financial services in Africa.

In Part III, issues relating to Central Bank Independence and Monetary policy are discussed in 5 chapters. The first chapter in this part of the book looks at how increased independence of Central Banks have helped improve effectiveness of monetary policy in the management of inflation and how this effectiveness differ by the exchange rate regimes. Another chapter explores how the central Bank independence promotes financial development in Africa by making monetary policy more credible. There is another chapter that discusses credit information sharing institutions and how that has complemented financial market developments in Africa. The remaining two chapters in Part III discusses the relationship between monetary policy and risk taking behavior of banks, and also how monetary policy mediates the effect of banks pricing behavior on financial inclusion in Africa.

Three chapters on Structured Finance, sustainable finance and Islamic Banking are discussed in Part IV. One chapter discusses how the structure of finance could be employed to respond to the changing financing demands of corporate firms and governments. This is then followed by a chapter that looks at the trends in policies, practices and challenges of sustainable finance and banking in Africa. The last chapter in this section provides an overview of Islamic banking and finance as an important alternative to conventional models in the face of recent experiences of financial crisis.

In Part V, the banking crisis as well as the implications of global banking for Africa are discussed in 4 chapters. The first of these chapters looks at the causes, consequences or effects of banking failures in Africa. The chapter that follows examines the impact of cross-border banking on the likelihood of banking crisis in Africa. Another chapter discusses how cross border banking and bank pricing affects financial inclusion in Africa. The last chapter in this section of the book discusses current developments, challenges, opportunities and the future of global banking and what their implication are for African banks.

Part VI comprise of 5 chapters that treats topics relating to Banking regulation and supervision. It starts with a discussion of risk management and compliance in banking in Africa. This is then followed by a chapter that examines how country-level governance structures affect the relationship between financial sector transparency, regulations and banking stability in Africa. The next chapter then discusses the role that monetary policy plays in shaping the relationship between macro-prudential regulations and what it means for the likelihood of a banking crisis in Africa. This is followed by a chapter that provides an overview of recent developments in banking regulations and supervision in Africa. The last chapter in this section discusses the challenges confronting the adoption of supervisory and regulatory technology in Africa.

In the last section of the book, Part VII, issues relating to non-Bank Financial Markets are discussed in 8 chapters. This section of the book starts with an overview of the sustainability, growth and impact of micro financial institutions (MFIs) in Africa. This is then followed by a discussion of the nature and characteristics of insurance markets in Africa. Another chapter also discusses the role of pension reforms, pension markets and capital market developments in Africa’s pension market. This is followed by two chapters that discusses respectively the stock market developments, and bond market development in Africa. There is a chapter that also discusses the relationship between private capital flows and energy use in Africa. The penultimate chapter discusses the relationship between foreign direct investments and stock market development in Sub-Saharan Africa. The final chapter discusses how African governments have responded to pandemics generally, and with emphasis on the Covid-19 pandemic and Africa’s financial systems.