By Eugene Davis

President Nana Akufo-Addo says he is upbeat about the country’s chances of securing the much-awaited bailout from the International Monetary Fund (IMF) by end of the month.

However, he minced no words when he added that a deal with the Fund will not restore the country’s fortunes overnight but rather set it on the road to recovery.

Delivering the State of the Nation Address in Parliament yesterday, the President said: “We look forward to their fast-tracking the needed financing assurances for IMF approval. We are confident that, with their co-operation, we will reach our March deadline for going to the Fund.”

He added that “concluding the arrangements with the Fund will not restore our fortunes overnight, but it will set us on the road to recovery. With fiscal discipline, we will regain the trust and confidence of our business partners and the investor community, which will give us space to continue our productive plans and policies.”

The West African nation is striving to obtain executive board approval for a $3 billion bailout.

According to the president, he remains resolute in his vision to restore macroeconomic stability and promote inclusive growth.

He also indicated that government is making progress on the external debt negotiations since it announced an external debt service suspension on 19th December 2022 for certain categories of external debt to ensure an orderly restructuring.

“This suspension is an interim emergency measure toward a comprehensive external debt operation which will contribute to the restoration of our debt sustainability in line with our request for a debt treatment under the G20 Common Framework. I want to express our appreciation to the members of the Paris Club and to the Peoples’ Republic of China for the co-operation they have so far exhibited to us in attempting to reach an agreement, and in their attempt to establish an Official Credit Committee.

However, in addition to our engagement with the Fund, we are also seeking and implementing some original and innovative ideas to try to solve our problems. For example, the Gold Purchase Programme by the Bank of Ghana and the Gold for Oil Policy are creative use of our resources, which are already bearing fruit.

These policies are aimed at achieving two results that are critical to the health of our economy. Firstly, they will help us preserve foreign exchange, especially the US dollar, and secondly, they will enable us to stabilise the price of oil products such as petrol and diesel on the domestic market. We have already seen some success on both fronts with the price of US dollars and petroleum products falling since we announced the policy and began to implement it.”

The average price of petrol at the pump, which had risen to twenty (20) cedis a litre, in the middle of December 2022, is now thirteen cedis and eighty pesewas (GH¢13.80) a litre. The price of diesel had risen to more than twenty-three cedis and seventy pesewas (GH¢23.70) a litre and is now selling on the average at thirteen cedis and eighty pesewas (GH¢13.80) a litre, which is a reduction of almost ten cedis a litre.

We expect this trend of falling fuel prices to reflect soon in our daily lives, since transport fares affect the price of everything. I hope the trend of prices going up and coming down become a regular feature of our retail economy as is being demonstrated in the fuel prices. Because, as we all know, prices, especially of petroleum products, used only to go up in our country.”

Despair and Disenchantment, minority says

Minority Leader, Dr. Cassiel Ato Forson, stated that the president’s scorecard has not been impressive given the economic downturn.

Reacting to the president’s statement he said “Mr. President, there is indeed a widespread of despair and disenchantment amongst our people. Millions of Ghanaians are going through unbearable hardships and excruciating pains. Our economy is in its worse shape in decades.

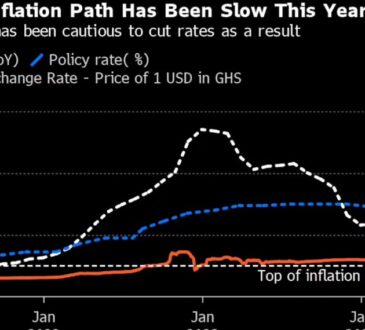

Ghana’s economy is bankrupt and we have officially defaulted in repaying our debts since January 2022, yet your government is failing to cut down on the size of government and public expenditure. Ghana is witnessing hyper inflation because your government allowed the Bank of Ghana to print Ghc50bn for 2022 and another Ghc4bn in the year 2023 first quarter,” he stated.