By Benson Afful

The Association of Ghana Industries (AGI) says it is disappointed at the passage of three new revenue bills by Ghana’s parliament last week.

The tax bills– Excise Duty, Growth and Sustainability Levy and Income Amendment Bills– which were passed late on Friday before the adjournment of parliament sparked resistance from the minority in parliament but government maintained the bills were needed to aid the government’s quest to facilitate the Board Approval for the US$3 billion International Monetary Fund (IMF) Programme staff-level agreement.

The AGI in a statement accused the government of imposing a tax regime that does not support local production and formal business operations.

They were also disappointed with the lack of consultation with stakeholders on fiscal policies that have a negative impact on businesses.

The association said although the AGI made submissions to the bills, their input did not receive the consideration they expected.

The international and domestic bond markets are shut for the financing of government programmes, forcing the government to rely on Treasury Bills and concessional loans as the primary sources of financing for the 2023 fiscal year.

Government in justifying the introduction of the taxes said they are critical for recovery from the current economic crisis.

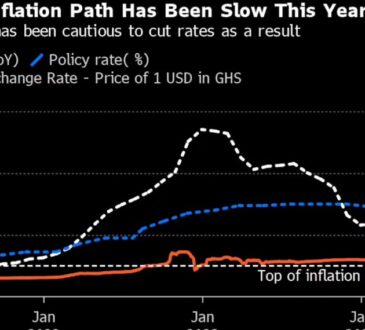

Ghana is battling its way out of a generational economic crisis by hiking interest rates at record speeds, cutting spending, and restructuring its debt as a condition to obtain support approval from the IMF’s Executive Board.

However, the AGI reacting to the passage of new taxes said its members are already struggling with inflation at 52%, VAT at 15%, water tariff increments of about 172% for the beverage sector, electricity tariff at 29.9% for the industry, policy rates at 29.5%, and an unstable foreign exchange regime.

The AGI warned that the imposition of new taxes on top of these existing issues will lead to a contraction in manufacturing and other related business activities.

The Association called on the government to engage in dialogue with them on how to incentivize local industries to avoid the negative consequences of these policies.

It said it would continue to engage with the government on such fiscal policies to bring positive reviews in subsequent national budget statements.