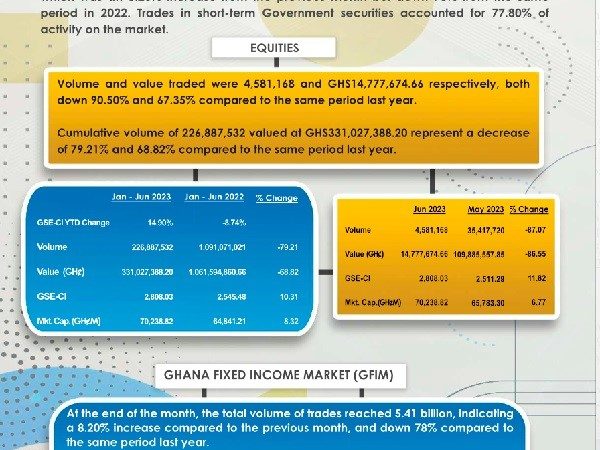

The GSE Composite Index achieved its second-highest monthly return to date, advancing by 296.74 points, marking a positive performance for the first half of the year with a year-to-date return of 14.90 per cent.

The GSE Financial Stock Index gained 14.56 points, reducing the year-to-date losses to 17.57 per cent.

The GSE market capitalisation achieved a significant milestone, soaring to a remarkable all-time high of GH¢70.24 billion.

This came on the back of improved investor confidence and several listed companies announcing dividend payment dates.

In terms of trading activity, both volume and value traded decreased significantly by 87.06 per cent and 86.55 per cent respectively, compared to the previous month.

Notably, the top five price gainers for the month were GGBL (28.48%), MTN GH (21.10%), CAL (20.00%), GLD (18.16%), and SCB (3.28%).

GSE’s fixed income market ended June 2023 with 5.41 billion in volume traded, which was an 8.20 per cent increase from the previous month but down 78 per cent from the same period in 2022.

Trades in short-term Government securities accounted for 77.80 per cent of activity on the market.

Volume and value traded were 4,581,168 and GH¢14,777,674.66 respectively, both down 90.50 per cent and 67.35 per cent compared to the same period last year.

The cumulative volume of 226,887,532 valued at GH¢331,027,388.20, represents a decrease of 79.21 per cent and 68.82 per cent compared to the same period last year.

At the end of the month, the total volume of trades reached 5.41 billion, indicating an 8.20 per cent increase compared to the previous month, and down 78 per cent compared to the same period last year.

From January to June 2023, the cumulative volume traded amounted to 40.89 billion, a decline of 67 per cent compared to the 124.07 billion traded during the same period last year.