By Eugene Davis

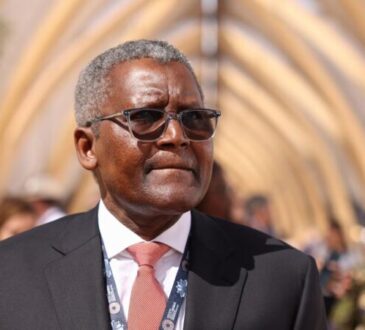

Prof. Joshua Yindenaba Abor, Former Dean of the University of Ghana Business School (UGBS), and Afreximbank Research Fellow has highlighted the potential of directing climate finance into the host country to boost the positive impact of intra-African trade on inclusive growth.

He explains that the impact of international trade on growth can be positive or negative, depending on an economy’s trade environment and resource level. Climate finance, he notes, is a crucial avenue for promoting inclusive growth.

To accelerate economic recovery and build financial resilience in Africa, policymakers and researchers are debating the centrality of climate finance and international trade in designing sustainable inclusive growth solutions.

The supply of capital to developing economies to facilitate trade, and achieve climate objectives and global SDGs, has become a major issue, making climate finance and trade an interesting research area to explore.

Prof. Abor, while presenting a paper on ‘Climate Finance, International Trade, and Inclusive Growth in Africa,’ asserts, “Specifically, climate finance can enhance the positive impact of intra-African trade on inclusive growth, and mitigate the negative effects of trade openness as climate finance increases.”

He emphasizes the importance of promoting policies that maximize available resources through leveraging climate finance to support intra-African trade. Moreover, he stresses the need for close collaboration between climate finance support and trade policies to maximize adaptive opportunities for greater inclusive growth.

Furthermore, Prof. Abor argues for increased allocation of funds through climate finance development projects to bolster inclusive trade policies and incentivize investments in the trade ecosystem, ultimately advancing inclusive growth.

According to Prof. Abor, many studies support the trade-led growth hypothesis (Kumari et al., 2023; Chen et al., 2022; Asiedu et al., 2021).

However, some studies reveal the heterogeneous impact of trade on growth due to the extent of trade openness and the different proxies of trade debt. (Ali et al., 2022; Islam, 2022).

He argues that though some studies exist on how climate finance could work in filling the finance-growth gap, the use of international trade as a mechanism is lacking.

Given that African trade systems are now embracing climate finance, achieving climate objectives, and creating the enabling environment for inclusive growth.

A United Nations Conference on Trade and Development report, reveals that climate finance commitment was set in 2009, which aimed to mobilize $100 billion per year for developing countries by 2020. The $100 billion commitment, which in any case has not been met, will expire in 2025.

In the United Nations Framework Convention on Climate Change’s recent analysis of financing needs, developing countries require at least $6 trillion by 2030 to meet less than half of their existing Nationally Determined Contributions.

To put that challenge in perspective, estimates by the Organization for Economic Co-operation and Development and Oxfam suggest that the actual flow of climate finance from developed to developing countries in 2020 was between $21 billion and $83.3 billion.