Zenith Bank Ghana assets reach GH¢13 billion, profits surpass GH¢1 billion due to high customer confidence

Zenith Bank Ghana had a standout year in 2023 with total assets increasing by almost 44 per cent, reaching GH¢13.86 billion, while profit before tax soared to GH¢1.02 billion.

This marks a significant turnaround from the GH¢554.6 million loss recorded in 2022 due to the Domestic Debt Exchange Programme (DDEP), representing a 284.35 per cent reversal.

High customer confidence was a major factor behind the bank’s success, with deposits increasing by GH¢3.32 billion to reach GH¢11.7 billion for the period. Additionally, the bank expanded its loan book to GH¢2.25 billion, up by GH¢390.7 million compared to the previous year.

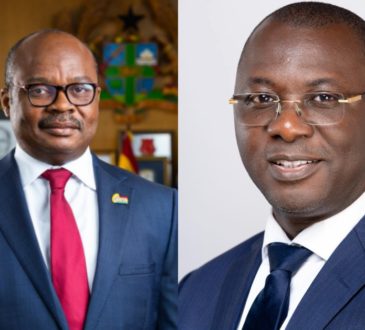

The Managing Director/Chief Executive Officer (MD/CEO) of Zenith Bank Ghana, Mr Henry C. Onwuzurigbo, expressed excited over the level of trust customers have in the bank’s stability and financial strength.

“This deposit mobilisation strengthened our liquidity position, allowing us to continue providing essential financial services to our clientele. Again, the upswing in lending activity is a positive indicator for Ghana’s economy. It indicates growing confidence in businesses and a potential increase in economic productivity,” he said.

As a result, interest income, a crucial measure of a bank’s lending and investment activities, surged by GH¢317 million to GH¢1.38 billion, underscoring the success of its strategies in loan origination and managing investment portfolios. Furthermore, fee and commission income also saw growth, increasing by GH¢49 million.

The standout of the year was the exceptional performance in trading. Net trading income more than doubled, soaring from GH¢156.7 million to GH¢332.6 million, possibly driven by favorable market conditions or strategic trading decisions by the bank.

The bank faced challenges that affected its net profit in 2023, including a GH¢109 million impairment loss on financial assets, which impacted the bottom line. However, this was significantly lower than the GH¢1.19 billion recognized in 2022, amounting to just a tenth of the previous year’s figure.

Operating income increased by GH¢546 million to GH¢1.6 billion, showcasing the underlying strength of the bank’s core business activities in generating healthy and consistent revenue. Additionally, the bank’s shareholders’ funds saw a significant improvement, rising by 68% from GH¢982 million post-DDEP to GH¢1.66 billion, reflecting its exceptional performance in 2023.

Market watchers believe that by addressing impairment losses and implementing cost optimization strategies, while simultaneously growing its risk assets and investment portfolio, Zenith Bank Ghana is well-positioned to translate its impressive revenue growth into long-term financial success. The bank’s focus on customer satisfaction and strategic revenue generation sets a strong foundation for a prosperous future.

The bank’s performance in 2023 sets a solid foundation for continued success in the years ahead.