Boosting financial stability: Ghanaian Men encouraged to prioritize investments, says Investcorp Dep. MD

Ghanaian men have been urged to cultivate a strong interest in investments to better handle their familial and societal responsibilities.

Speaking at a seminar organized by the telecommunication giant, MTN, in partnership with its media team in Accra on the topic ‘Investments for the Long Term,’ the Deputy Manager of Investcorp, a leading investment bank and asset management firm, Kwabena Apeagyei emphasized the importance of investment savvy in today’s economic climate.

He pointed out that the complexities of financial decision-making require a strategic approach to investing, particularly in diversifying portfolios to safeguard against economic downturns.

Mr. Apeagyei highlighted the critical nature of starting investments early in the year, stating, “It’s essential for men, who often bear significant financial burdens, to engage more in investments to secure their future and that of their families.”

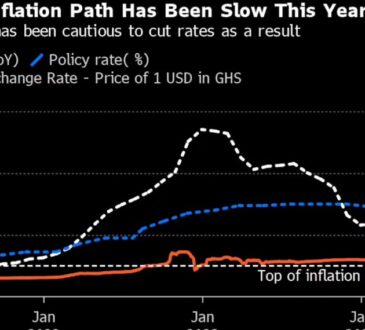

He also advised against reactionary buying and selling based on market fluctuations, noting that investments should generally be viewed as a long-term endeavor. Instead, he recommends setting clear investment goals and cautiously entering the market, keeping an eye on inflation rates to ensure that returns are worthwhile.

Moreover, Mr. Apeagyei pointed out common pitfalls in investment strategies, such as hoarding cash due to investment anxieties or failing to periodically rebalance investment portfolios, which can lead to buying high and selling low.

He also observed that many investors tend to favor familiar companies, often local ones, which might not always align with the best investment strategy.

Highlighting the importance of regular review, Mr. Apeagyei suggested that investors evaluate their long-term investment plans semi-annually to adjust to any significant changes in life circumstances or financial goals.

He further underscored the variety of investment options available, from equities and bonds to shorter-term vehicles like treasury bills and fixed deposits, encouraging investors to explore these avenues to optimize their financial portfolios.

A report on Gender Difference in Investment Decision Making: Evidence from Ghana” reveals that investment decisions have mainly been described as a man’s world. The impact of culture has marginalized mainly women in areas where men are perceived as front liners.

Long-term investments comprising shares, and bonds, as well as short-term term including treasury bills, and fixed deposits are some of the financial investments men can explore, he noted.

As the new year unfolds, Mr. Apeagyei and other experts advocate for a proactive approach to investments, emphasizing that timely reviews and strategic planning are key to achieving financial security and growth.

The new year tends to be a time when people consider their financial options, and even though it is just the first quarter, Mr. Apeagyei reckons it is not too late to explore investment decisions.

By Eugene Davis