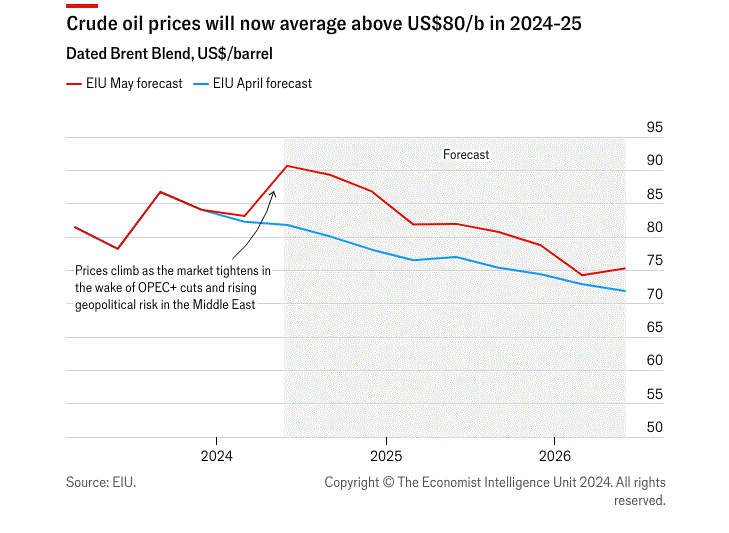

The Economist Intelligence Unit predicts that oil prices will persist above $80 per barrel until late 2025.

This is expected to elevate inflationary pressures in numerous countries, particularly as their currencies continue to depreciate against the dollar.

According to recent data from the International Energy Agency, the global oil market shifted into deficit in the first quarter of 2024, with demand surpassing production. In light of this changing supply-demand balance and escalating geopolitical tensions, we have adjusted our oil price projections upwards. Consequently, the EIU anticipate that Brent Blend will remain above US$80 per barrel until late 2025. This is expected to heighten inflationary pressures in numerous countries, especially as their currencies continue to depreciate against the dollar.

The EIU also forecasted that oil prices would continue trading at nearly $90 per barrel for at least the next few months. In addition to the market deficit, higher prices are expected to be supported by escalating tensions in the Middle East, as the Israel-Hamas conflict threatens to escalate into a broader regional conflict.

“Even if disruption to oil shipments from the region remains minimal and traders shrug off concerns about military escalation, prices are set to remain high as the global market remains in deficit until late in the year [2024]. We expect that OPEC+ will strictly observe reduced output quotas and that Saudi Arabia will continue to adhere to additional, sharp voluntary cuts until at least mid-2024 and only slowly lift production towards the end of 2024 at the earliest”, it pointed out.

The EIU added that “We continue to expect US production to increase moderately in 2024 before stabilising in 2025, but the recent rise in prices is not enough to elicit a stronger supply response. The US oil rig count, at 508, is actually down by 14% from a year ago, according to Baker Hughes, an oilfield services firm, as US oil companies continue to prioritise dividends for shareholders”.The EIU maintained its forecast that global oil demand would reach record highs in 2024 and 2025. Additionally, it noted that demand in developed economies is expected to decrease, although North America will likely remain an exception to this trend.