Analysts and market watchers at GCB Capital express optimism about the cedi’s prospects for the remainder of the year, forecasting the Ghanaian currency to stabilize by mid-2024.

Since February 2024, the cedi has been undergoing a rapid depreciation trend, primarily attributed to persistent corporate forex demand pressures.

Despite this depreciation, key economic indicators in Ghana suggest an improving macroeconomic environment.

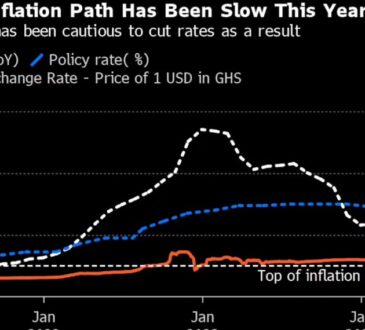

The country’s GDP growth is forecasted to modestly increase from 2.9% in 2023 to 3.3% by the end of 2024, while average inflation is anticipated to decline from 38% in 2023 to 18% in 2024.

To bolster the local currency, the Central Bank sold US$13 million in the spot market earlier this week and also auctioned $20 million to Bulk Oil Distribution Companies (BDCs) in the 51st auction.

However, the cedi still depreciated against major trading currencies in the first quarter of 2024, albeit at significantly lower rates compared to previous years.

The lead researcher at GCB Capital, Courage Boti perceives recent developments as a ray of hope for the cedi’s stability in the short term.

He attributes this positive outlook to the improving macroeconomic conditions and the potential for the Bank of Ghana’s auctions to absorb increased forex demand.

“In my engagement with the traders, what they see is a pile-up of demands from the corporate sector, largely the BDCs, who are just about more or less 20% of the IFAX needs from the BDCs auction that the Bank of Ghana conducts every fortnight. So, they source the rest from the open markets and also from the other corporate sectors. You could immediately think about things like the seasonal trends that we know from before; dividends repatriation in the second quarter,” he said.