Prof. John Gatsi, Dean of the University of Cape Coast Business School, has criticized the Central Bank’s recent warning to currency speculators as a “desperate” move.

The Central Bank cautioned that those betting against the cedi would regret their actions, but Prof. Gatsi believes this approach is misguided.

Prof. Gatsi argues that instead of issuing threats, the Central Bank should implement measures to make speculation less profitable.

He emphasizes that speculators are legitimate market players who capitalize on market conditions, whether in forex, stocks, bonds, or futures, to make a profit.

“In the context of the cedi’s depreciation, speculators are rational market participants who use market information to gain. Transparency, robust market data, and stable regulations can mitigate the risk-taking behavior of traders and promote stability,” he explained.

Prof. Gatsi further stated that threats from the regulator, such as warning traders of potential losses due to new measures, indicate desperation.

He expressed concern that revealing information about future foreign currency inflows to influence traders’ behavior suggests a shortage of foreign currency supply.

“If supply is adequate, speculators cannot create a false scenario. Confidence should be instilled to dissuade people from investing in foreign currencies. Speculators exploit opportunities arising from incomplete information in the forex market. Proper economic management can make speculation less lucrative,” he added.

At the 118th MPC press briefing, Central Bank Governor Dr. Ernest Addison warned speculators that betting against the cedi would result in economic losses.

He reaffirmed the BoG’s commitment to exchange rate stability and assured that the bank has sufficient foreign exchange reserves to support the market.

“The bank has enough foreign exchange reserves to support the market, and economic agents should stop engaging in speculative purchases as they will suffer economic losses when the correction occurs,” Dr. Addison stated.

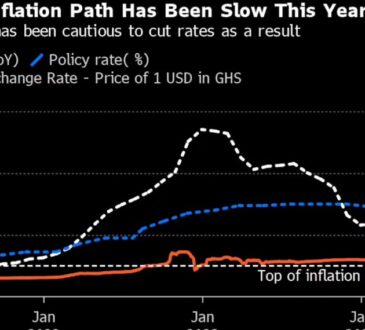

Despite these assurances, the cedi fell 0.3% to a record low of GHS 14.646 per dollar following the BoG’s decision to maintain its policy rate for the second consecutive time.

The cedi has depreciated by 10.5% against the dollar since late March, making it the worst-performing currency globally during this period.