Do not save what is left after spending, instead spend what is left after saving. Bad spending refers to spending your money in a way that could lead to heavy losses. It is also spending money in a way that amounts to wastage, and this could have a disastrous effect if you are living in an emerging economy like Ghana.

An emerging economy is one that is in-between being developed and undeveloped. They are characterized by policy instability, a GDP growth higher than 3%, low household income & purchasing power, and unstable domestic currencies.

A press release by MasterCard says that about 79% of Ghanaian consumers turned to online shopping due to the Covid-19 pandemic. Online shopping is one of the elements that increase the temptation of spending your money unwisely.

Today there is talk of a recession globally due to high inflation, Ukraine-Russia war etc., and Ghana is no exception. You always need to avoid these bad spending habits so you can have emergency funds and a savings buffer at all times.

Not Budgeting

A budget is a way to monitor the money that flows into your pocket, what you are spending the money on, and the amount of your expenses. It lets you track how much money came in, and where the money left to.

Without a budget, you won’t be detect holes in your finances, and identify what takes the chunk of your money. These days’ mobile banking apps have inbuilt budgeting capability, so you can place a limit on how much you want to spend, and the app will remind you when you exceed it.

Excessive Leveraged Betting

Betting in itself is not illegal, and today in Ghana it is regulated by the government as they generate revenue from it.

The Ghana Gaming Commission headed by Peter Mireku, licenses and inspects all gaming participants such as casinos, sport betting, etc. to ensure standardization. But many people bet excessively & lose it all in gambling.

This being said, betting can also be carried out online in the financial markets where the regulators are from foreign jurisdictions, using a product called Contract for Difference (CFD).

CFDs allow you bet on price movements of the underlying asset without actually owning the asset.

Research carried out on licensed providers shows there are some CFD platforms that offer variety of asset classes like stocks, Forex, indices, commodities, etc. & accept clients from West African countries. Many of these brokerages are quite popular in Ghana as well, despite being unregulated.

However, the danger in CFDs is that since underlying asset prices change in small decimals, you need to stake a lot of money to increase your profits, so your CFD broker borrows you money (leverage).

If the leverage is 1:100, you can bet 100 times your initial budget. The danger is, you can also lose 100 times your budgeted amount.

It is safer to use lesser leverage like 1:10 where your loss will be only 10 times your initial budget so as to manage risk. But all this still is very risky for the general public & should be avoided.

Emotional Purchases

Emotional spending is when you buy something under the influence of emotions such as happiness, anxiety, sadness, stress, etc.

You can spend all your money on things you don’t actually need, because you are acting irrationally. These tips help curtail emotional spending:

- Before buying something out of excitement, take some time to ask yourself if it is a want or a need.

- Identify what triggers you to spend irrationally, as doing so would help you put your spending in check.

- Instead of resorting to emotional spending, try other means to deal with your emotions like meditating, taking a walk or talking to therapists.

- Don’t go out with your credit card always, so as to keep the temptation of emotional spending at bay.

Spontaneous Purchasing

Spontaneous or impulse buying is when you purchase something you have not planned for.

Such spending happens unexpectedly, most especially when you come across some products that are appealing to your eyes. Signs of Spontaneous Purchasing include:

- When you keep on spending more than you plan

- Feelings of regret after a purchase.

- When you frequently patronize stores that often trigger your unplanned purchases.

- Frequently returning the products you buy.

Not Diversifying Your Investments

Diversification is an investment strategy where you spread your capital in a mix of different investing instruments, so as to limit your exposure to risk.

If you invest in the stock market, you should consider buying Exchange Traded Funds (ETFs) because they contain a basket of stocks, so with little money, you own bits of various stocks.

You should also consider adding government bonds to your investment portfolio. Buying bonds from government means lending your money to them in exchange for a regular interest payment, and a refund of principal upon bond maturity.

As an investor, putting all your resources into only one asset class, is a bad spending habit. If you had invested 100% in one company’s stock, and the company goes down, you could lose everything.

Using Credit Cards

Using credit cards to make purchases on daily basis is not bad if you are not being controlled by your impulse. You need to use your credit card in a responsible and disciplined way. Tips to use a credit card responsibly:

- Settle the entire balance to avoid charges of minimum payments.

- Read your Credit Card Statement regularly so as to help you budget.

- Avoid buying things you cannot afford so as to save yourself from the discomforts of debts.

- Don’t apply for credit cards you don’t need as it causes more debts and affect your credit card score

Why Bad Spending Habits Are Risky

1: The US Dollar is Getting Stronger

As a general rule, when interest rates are hiked, a currency strengthens. When the USD sneezes, other currencies catch a cold.

In July 2022, the US Federal Reserve Bank in a press release stated that interest rates had been hiked to 2.25%-2.5%

Here at home, the Ghanaian Cedi has depreciated by 36.3% so far this year, a development that now makes it the second worst-performing currency globally, after Sri Lanka’s currency, the Rupee.

As the Cedi losses value, this has led to an increase in the cost of imported materials used for local production. This means goods become more expensive as the extra cost is passed from manufacturers down to you.

In this fragile economy, if you still have the habit of bad spending without of planning, saving and diversifying, you may be caught in the web of financial frustration and abject poverty.

2: Inflation Is On the Rise

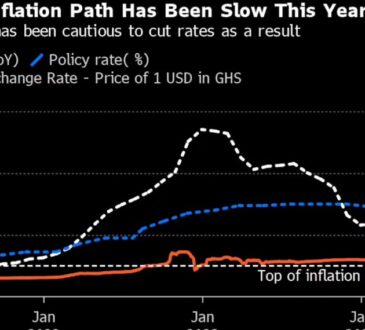

Inflation can be defined as the rate at which prices of goods and services increase within a particular period. The Inflation rate of Ghana is now 31.7% as of July 2022.

Explaining the causes of the inflation, the President of Ghana, H.E. Nana Akufo-Addo said “The ravages of the pandemic, worsened by the effects of Russia’s invasion of Ukraine, have led to spiraling freight charges, rising fuel costs, high food prices, steep inflationary spikes and widespread business failures”

The Governor of the Bank of Ghana (BOG), Dr. Ernest Addison, also described the rising inflation rate as a surprise to the team of the apex bank, but said they would take the right decision on it.

“It’s an issue which in a sense is baffling to all of us,” Addison said.

During Inflation, the purchasing power of people is decreased, as money declines in value.

Therefore, if you are a bad spender at this period, you would not have what it takes to guard yourself against the devastating effects of inflation

3: Interest Rates Are Increasing

Interests rate are the percentage of the principal amount charged by a lender to a borrower when issuing a loan.

Central banks mainly increase interest rates to make borrowing more costly and discourage spending so as to reduce inflation in an economy.

Commercial banks borrow money from Central Banks like the Bank of Ghana (BOG) at a repo interest rate and then lend this money to the public.

If the Central bank charges the commercial banks a higher interest rate, it is passed down to you, the lender.

Due to the rising rates of inflation, BOG issued a Monetary Policy Committee statement where it jerked up its interest rate to 22% so as to tackle inflation. This means commercial banks may charge you higher than 22% interest on loans.

Bad spending would be indeed very risky for you at the moment because the higher interest rates would limit your access to loans.

Furthermore, there would be higher interest payments on your credit cards, which would affect your disposable income.

4: There Are Fears of a Global Recession

A recession is a period with a massive decline in economic activities, caused by a weak Gross Domestic Product GDP, and can last longer than a few months.

If a country enters a recession, it would be tougher for the citizens, because recession is associated with high rate of unemployment, and decline in real incomes.

With the current economic challenges in Ghana, experts are already saying that the economy is at a brink of going into a recession if decisive and concrete actions are not taken.

Due to the high cost of living during recession, you should resort to strict budgets and severe cuts in your spending. You could also be laid off in your place of work as a result of decline in sales of companies.

Save Money, & Money Will Save You

If you have been a bad spender, now you have known the effects of such bad habit and some tips on how to tackle. Focus on saving money and investing wisely so as to build generational wealth.